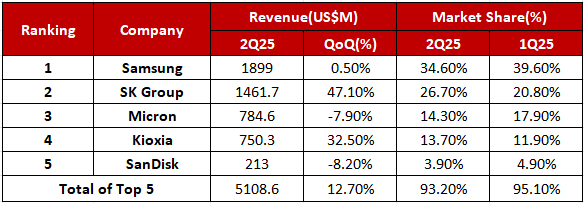

Both AI and general-purpose server demand have driven significant growth in demand for enterprise SSDs. The top five brands achieved combined revenue of over US$5.1 billion, a 12.7% QoQ increase. However, DDR4 shortages and extended lead times for controller IC substrates have led to a widespread supply shortage for enterprise SSDs, impacting each manufacturer's market share and revenue performance in the second quarter.

2Q25 Enterprise SSD Top Five Brands Revenue Ranking

Analysis of SSD brand manufacturers' second-quarter revenue performance

.png)

Thanks to the widespread adoption of its products in the North American market and its lack of impact from the DDR4 shortage, Samsung secured a large number of urgent orders, achieving revenue of nearly US$1.9 billion, maintaining the same level as the previous quarter and solidifying its leading position in the market.

SK Group

SK Group (including SK hynix and Solidigm), ranked second in terms of revenue, saw its quarterly revenue surpass US$1.46 billion, a 47.1% increase from the previous quarter, primarily driven by a rebound in demand for large-capacity SSDs and a doubling of orders from key North American CSP customers. Its revenue surged 47.1% from the previous quarter, demonstrating the strongest growth momentum.

.png)

Micron Technology's second-quarter revenue exceeded US$780 million, a 7.9% decrease from the previous quarter, maintaining its third-place ranking. Due to a slight delay in the verification and ramp-up of some of the company's high-capacity products in the second half of the year, future revenue growth may be affected.

Kioxia's second-quarter revenue increased 32.5% from the previous quarter to US$750 million, and its market share steadily increased to 13.7%, placing it in fourth place. The key to the company's growth lies in its industry-leading Hybrid Bonding technology, which has become essential for enabling AI applications through high-speed transmission.

SanDisk

SanDisk's Enterprise SSD bit shipments continued to increase in the second quarter, with revenue reaching approximately US$210 million, a quarterly decrease of 8.2%. SanDisk is fully committed to developing next-generation products and has welcomed SK hynix to its HBF (High Bandwidth Flash) R&D team, strengthening its technological capabilities through this alliance.